Data Centers and the Finance Industry

The financial sector is among the top industries that rely on quality data centers for service provision. It helps banks manage and store big data coming from customers. These data centers come with some trends that banks should focus on if they want to grow in the future.

So, here we'll look at the new approaches to managing financial data centers and the benefits of financial services. But let's start with data center trends for the financial services industry.

Key Data Center Trends for the Financial Services

Important data center trends shape today’s growth in data centers’ provision of financial services. It will help your company plan for proper future data center rollouts. So, here are the trends you'll see.

1. Data Centers and the Financial Services Industry

In the future, data centers will be the backbone of the financial sector’s growth. The centers help banks manage the rising need for data storage. So, every institution should embrace ways to adapt to data center infrastructure.

2. Performance

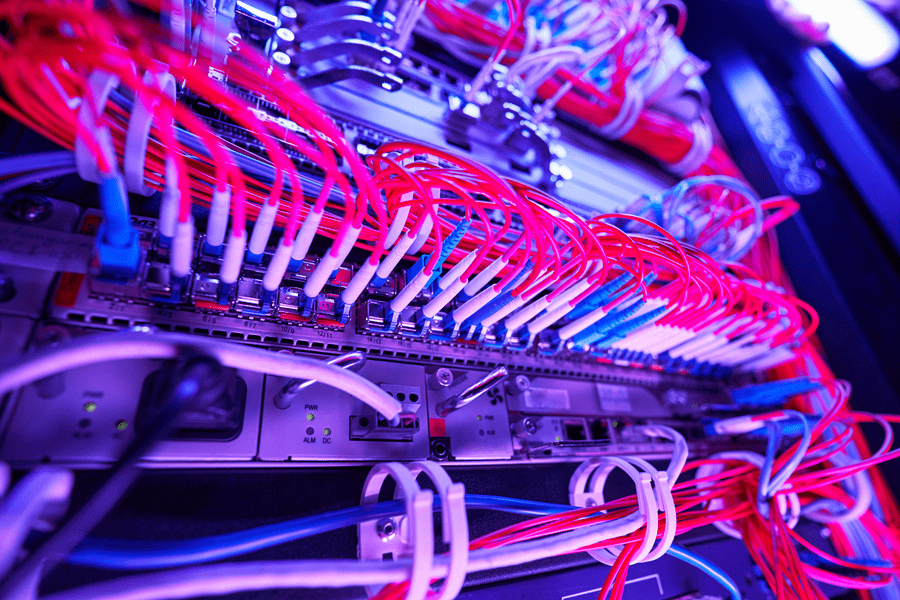

Speed is the key to managing financial institutions and maintaining proper customer relationships. Also, fast, reliable, and flexible networks are essential for any system’s performance. It allows banks to compete well against their rivals.

3. Big Data

Today and in the future, companies will go for data centers that support big data management. Before that, banks need to know the size and nature of the data coming from their customers before choosing a data center.

4. Security and Regulation Controls

Since 2013, there has been a rise in the number of cyber-attacks and breaches of debit and credit cards. So, expect companies to go for data centers with high security and privacy.

5. Software-Defined Network (SDN)

Most financial companies look to use programmable SDNs to manage data centers. It helps companies improve on deploying their apps and service delivery. Also, more banks will be able to meet many business objectives by converging management networks and services to central platforms to promote automation.

New Approaches to Managing Financial Services Data Centers

Every financial company should have plans to manage their financial services data centers. It helps reduce the risks involved in data management and improve performance.

The financial sector should learn ways to identify and remove waste that might create huge risks. New designs should meet present data risk demands and allow companies to grow in the future.

Also, choosing the proper colocation space is vital in reducing risks and satisfying short-term and long-term needs. It frees up resources and allows banks to use them to operate other growth activities.

Key Advantages of Financial Services

There are various benefits that customers and financial institutions get when using data centers for financial services. Read on to find out, as some of them may be a solution to your problems.

● They are Secure

The data centers have a multi-layered security approach. A tight structure keeps your data from possible cyber security breaches.

● Cheap and Flexible

Getting these financial services is cheap for both the users and financial institutions. Also, the technology providing the services is flexible, allowing for storage and management of big data as proper service provision continues.

● The Services are Fast and Reliable

Together with their customers, the service providers enjoy fast data transmission. It allows speedier service provision, which builds trust between the bank and customers. The speed provides proper data analytics to check for errors and good planning.

● Great App Performances

The financial institution will have direct access to the network services providers. So, there will be fewer cases of latency, and the data services apps will perform better.

● You'll get Special Care from Service Providers.

These services come with special care from the service providers. Your bank will have more chances to grow within any superior colocation area.

Modern data centers are safe and reliable in the financial sector. As this technology grows, it brings some trends that financial companies should consider for them to prosper. Looking at financial services, they aim to improve the industry as their customers get satisfaction. Data centers will shape the sector in the coming years.